Financial transactions - add new

![]()

This will bring you through how to create a new transaction and void a transaction.

It will also give you more information on the terminology used.

Creating a New Transaction

![]()

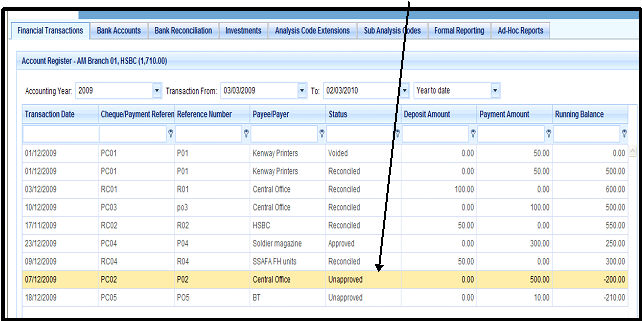

Amend Transactions

Select and Double click on the transaction that needs to be amended

![]()

All fields can be amended apart from payee and amount. In the case where the amount is incorrect,

you will need to void the transaction and start again, by create a new transaction

![]()

Void Transactions

Select and double click on the transactions you would like to void

![]()

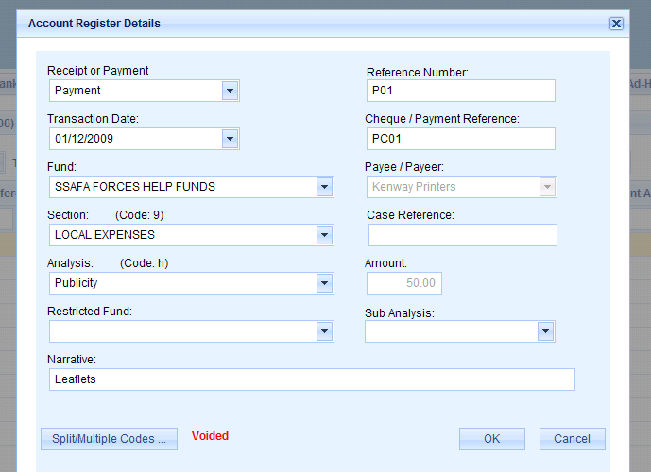

This will bring up the transaction details

![]() Select the Void Transaction Button

Select the Void Transaction Button

NOTE: 1. A transaction can only be voided if it has not been reconciled

2. Once the auditor has signed off a year, new transactions in that year cannot be voided by Treasurers, only central office staff.

3. Once central office has signed off the year. No further transactions can be voided for that year.

![]()

A warning sign will appear to ask you if you are sure you want the transaction to be voided

Select OK

The transaction is now voided

![]()

NOTE: The transaction will still appear on your list of transaction but will be shown as voided for

audit purposes.

Splitting Analysis Code (if the transaction amount is split between analysis codes)

![]() Once you have selected the appropriate Fund and Section the

"Split Multiple Codes" button will be

Once you have selected the appropriate Fund and Section the

"Split Multiple Codes" button will be

available

Select "Split Multiple Codes"

![]()

Select "Add Item"

Enter the following details

![]() Analysis Code (mandatory): Select

the appropriate code from the dropdown list

Analysis Code (mandatory): Select

the appropriate code from the dropdown list

Sub Analysis Code (optional): If the analysis code selected allows for "sub analysis" select from dropdown

Case Reference Code (mandatory): If the analysis code selected requires a case reference.

Amount (mandatory): The Amount

Narrative (mandatory): Free Format

Add as many items as required and then select OK

You cannot save the transaction unless the total value of the split items = the transaction amount.

The transaction will display the difference between the transaction value and the split value.

![]()

TERMINOLOGY

Fund Types

There are three types of funds that can be used by a SSAFA Volunteer Group:

Sections

Within each Fund Type are sections to break down and analyse income and expenditure. The

sections are to qualify categories of expenditure such as local income and receipts, grants

to cases.

Analysis Codes

Within each section are analysis codes to further categorise income and expenditure.

Examples include fund raising income, gift aid tax recovered and office accommodation

expenses.

![]()

Analysis Code Extensions

There are standard Analysis Codes within each section that SSAFA stipulate

should be used. It may be the case in some circumstances that there are exceptional items

of income or expenditure that do not fit into one of these Analysis Codes. In that case a facility

is provided in the FMS for the user to create additional Analysis Codes in a section.

As a note of caution, it is important to be sure that one of the existing Analysis Codes cannot

be used for the item of income or expenditure before creating an Analysis Code Extension.

Using the standard Analysis Codes ensures that all income and expenditure is categorised

and consolidated in SSAFA. Adding an Analysis Code unnecessarily (e.g. using

a new code for a fund raising event) will distort the final figures for the Association.

Sub Analysis Codes

Sub Analysis Codes provide a further level of analysis of income and expenditure beyond the

standard Analysis Codes. An example would be to break down local expenses where there is

one Analysis Code for all of telephone, postage and stationery into three separate sub analysis

codes for telephone, postage and stationery.

When Sub Analysis Codes are used, the formal report that is required centrally be SSAFA

will only be shown at the analysis code level; Sub Analysis Codes are included

in transactions and can be reported locally if required.